Financial Freedom

As we end one tax year and start the next, many businesses will be taking a closer look at their figures, some for the first time in a while.

Perhaps your accountant has already booked you in for your annual catch up (although if you only hear from them once a year, it might be time to think about switching).

But regardless of whether your accountant is on the ball or not, it’s as good a time as any to review your financial position.

And I’m not talking about the figure on your bottom line. I’m talking about whether your business provides you with the lifestyle you want.

There’s no point working round the clock only to come out with less than minimum wage at the end of the month. Or even working round the clock to ensure you have the money you want, but never having time off to enjoy it. And yet, it’s what so many business owners end up doing.

They fall into the trap of trying to do everything in their business to save a bit of cash. “I can’t afford to outsource or recruit!” I often hear. But that inevitably means working countless hours doing stuff you don’t really enjoy. This leads to exhaustion, overwhelm and loss of your mojo.

I doubt you went into business to do the stuff you hate – nobody does. So why do it? You should spend your time doing the stuff you love and the stuff that ignites your fire. Outsource the other stuff or hire people who love doing it.

Until you do, you will forever be trapped by the very business your thought would free you.

Build a dream team

If you want to grow your business, you have to invest in systems, marketing and people. But you have to invest in the right people, whether that’s employees, freelancers or external consultants.

It can be easy to focus on the cost of outsourcing or hiring rather than the value, but that’s a big mistake.

Let’s say you spend four hours a week on admin tasks you don’t enjoy. You could hire a VA to do them for you at £30 an hour, which works out at £120 per week.

And it’s easy to focus on that cost – it works out around £6k a year. That’s a lot to spend on something you can do yourself, isn’t it?

Or is it?

Because if you bill your time at £60 per hour, and you free up an extra four hours, then you’re actually going to be better off every week. You might be spending £120 to get those four hours, but you can use them to make £240. So essentially, you’re going to be £6k better off every year. And you’ll be spending the time doing stuff you love, not stuff you hate.

Plus, those tasks you hate might take you four hours, but they might only take a VA two. Even better.

So stop focusing on how much outsourcing will cost you and start focusing on how much time you’ll get back to do the stuff you want to be doing – the stuff that makes you money.

Know your value

Pricing is probably one of the most common things that business owners get wrong, and there are various reasons why.

One is that they try and compete on price. They undercut competitors to win more business. But if you want to be the cheapest, you’ll only attract cheap clients. Clients that don’t value what you do. That means you’ll be working with people who don’t appreciate you, and you’ll be doing work you don’t really want for not a lot of return.

Another reason business owners get pricing wrong is because they price on time rather than value.

You might well have heard a version of the story whereby a machine breaks down, and nobody in the company can figure out the problem. So they bring in an engineer who taps the machine with a hammer and it instantly starts working again. He then bills them for £1000 and when they question the fact that all he did was hit it with a hammer, he tells them, “but the charge is for the fact that I know where to hit it.”

There are several versions of this story and similar stories, but the point is the same.

Sure, it might only take you an hour to design that logo or a day to code that piece of software, but how long did it take you to develop the skills to do it? And how much value will it add to the business you’re doing it for?

If you understand who your ideal customers are and how you add value for them, you can charge prices that reflect that value.

And if your marketing addresses their pain points and clearly shows how you add value, then your ideal customers won’t question your pricing.

So, if you want to charge the prices you should be charging and getting the customers you should be getting, you need to articulate who those customers are, the problems you solve for them and the impact of the solution.

Achieve financial freedom

Once you are in a position where your pricing is right, you have great customers, and you’ve built the right team around you, you’ll be well on your way to financial freedom.

Your team will take care of the operations while you do more of the things you love – the things you dreamt you’d be doing when you decided to start a business.

You’ll be attracting the right customers at the right price because you’ll be clear on your purpose, your ideal client and the value you add.

Your customers will stay and they will be recommending you to their connections, keeping your existing business and your pipeline healthy.

And as a result, your business will be generating enough money to fund your business growth and provide you with the lifestyle you want.

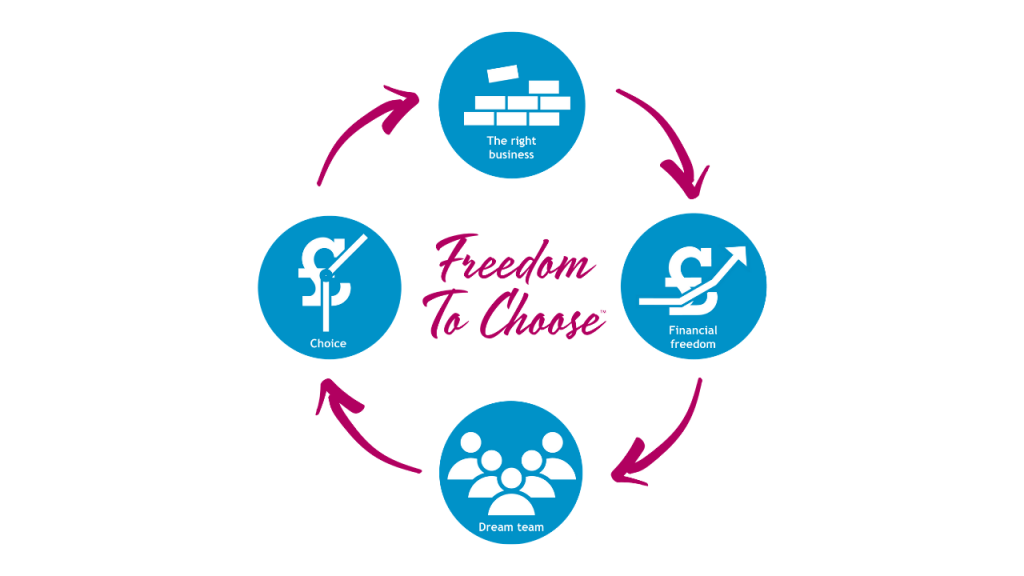

That’s what financial freedom is all about – building a business that gives you the freedom to choose. The freedom to be able work where, when and how you like and to have the financial freedom that gives you the lifestyle you desire and the ability to invest in your business.

Over the years, we’ve done extensive research and found that an extra £5k per month would transform the financial situation for most business owners. Do you know what your financial freedom figure is?

If not, my freedom calculator can help you work it out. It’s free – just follow this link to access it.